12 best turbotax

TurboTax is a widely used tax preparation software that helps individuals and small businesses in the United States file their federal and state income tax returns. Here are some key points about TurboTax:

Overview: TurboTax is developed by Intuit Inc., a financial software company. It is one of the most popular tax preparation software options available and has been used by millions of taxpayers.

User-Friendly Interface: TurboTax offers a user-friendly interface that guides users through the tax preparation process step by step. It uses a question-and-answer format to gather information about your financial situation and tax-related details.

Various Versions: TurboTax offers different versions of its software to cater to various tax situations. These versions include TurboTax Free Edition, TurboTax Deluxe, TurboTax Premier, TurboTax Self-Employed, and more. Each version is tailored to specific needs, from simple returns to more complex situations like self-employment income or investments.

Importing Data: TurboTax allows users to import financial information from various sources, including W-2 forms, 1099 forms, and financial institutions. This helps streamline the data entry process and reduces the chances of errors.

Guidance and Support: TurboTax provides guidance throughout the tax preparation process, including explanations of tax deductions and credits. It also offers access to tax experts and customer support if users have questions or encounter issues.

Accuracy Guarantee: TurboTax offers an accuracy guarantee, promising to pay any IRS penalties or interest resulting from a calculation error made by the software.

E-Filing and Refunds: TurboTax supports electronic filing (e-filing), which allows users to submit their tax returns electronically to the IRS. This can result in faster processing and quicker refunds if you are owed money.

Security: TurboTax takes data security seriously and employs encryption and security measures to protect users' personal and financial information.

Cost: The cost of using TurboTax varies depending on the version you choose and the complexity of your tax situation. There is a free version for simple tax returns, while more advanced versions come with a fee.

State Tax Returns: In addition to federal tax preparation, TurboTax also offers state tax return preparation for most U.S. states, though this may come with an additional fee.

Overall, TurboTax is a popular and reliable tax preparation software that offers a comprehensive solution for individuals and small businesses looking to prepare and file their income tax returns accurately and efficiently.

Below you can find our editor's choice of the best turbotax on the marketProduct description

TurboTax Deluxe is recommended if: you own a home, have charitable donations to deduct, have high medical expenses, and only need to file a Federal Tax Return

- TurboTax Deluxe is recommended if: you own a home, have charitable donations to deduct, have high medical expenses, and only need to file a Federal Tax Return

- Includes 5 free federal e-files and one download of a TurboTax state product ($40 value). State e-file sold separately. Free product support via phone

- Get your taxes done right and your maximum refund

- Extra help to maximize 350+ deductions and credits, including maximizing charitable donations with ItsDeductible

- Coaches you and double checks every step of the way

- Automatically imports W-2s, investment & mortgage information from participating companies (may require free Intuit account) and imports prior year data from TurboTax and other tax software

- Accurately deduct mortgage interest and property taxes

User questions & answers

| Question: | How many PCs can this be loaded on |

| Answer: | Per the license agreement, the license code provided can be used to download the software on up to 5 computers owned by you (either in your home or at work). |

| Question: | Does this download as a single installable file, or does it install as it is downloaded |

| Answer: | The installation download for TurboTax is a single file. Once you double click the installation file, onscreen directions will pop up and walk you through the installation process. You will need an internet connection to activate the TurboTax software after installation. See the article "How do I install TurboTax for the current tax year after I download it from the Internet?" on the TurboTax Community site for step by step directions and tips on getting the best install of the TurboTax software. |

| Question: | Schedule D for Capital Gains included |

| Answer: | Schedule D step-by-step is available in my Deluxe CD version. The valid form will not be available until the Jan 15 schedule Intuit update. But the step-by-step process is visible on my installed TT Deluxe CD version. TT tech support elsewhere has incorrectly stated the step-by-step is not, and manual entry is required by forms view, which invalidates the warranty, and cripples eFilie. The TT tech support is WRONG. You do not have to upgrade to Premier, IF you have the CD/download version. The following might give some insights: "The TurboTax Deluxe online edition does not support investments reported on a Form 1099-B. The Premier online edition must be used. The TurboTax Deluxe desktop CD/Download edition which has to be installed on a personal computer does support entry of an investment sale reported on a Form 1099-B. As do all of the desktop editions. All of the desktop editions include the same forms, schedules and worksheets " |

| Question: | Did anyone have an issue downloading this program? I tried every trick in the book and it still not download (would freeze a certain spot |

| Answer: | If you are having issues downloading the software from your Amazon Software Library, try the suggestions below: -Try a different supported web browser. -Confirm that your browser has the Javascript plugin enabled. -Confirm you have a stable Internet connection. (Note: Some network connections and secure VPNs have additional restrictions that block downloads.) -Confirm that your antivirus, firewall, or network settings aren't blocking the item's server or service provider. -Delete any previously downloaded files, and restart the download from Your Games and Software Library. For more suggestions on what you can do to resolve your software download issues, please visit our TurboTax Community website and search for the article titled: "Troubleshoot TurboTax for Windows downloading issues" or "Troubleshoot TurboTax for Mac downloading issues" If the issues persist, please contact our support team on Facebook or Twitter. |

Product features

Get your taxes done right with TurboTax 2020

- Get your taxes done right and your maximum refund

- Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately.

- Free product support via phone

- Extra help to maximize 350+ deductions and credits

- Accurately deduct mortgage interest and property taxes

- Coaches you and double checks every step of the way

Free Trial of Quicken Starter Edition 2021

- Get your complete financial picture at a glance--view balances, budgets, accounts and transactions, see spending trends and search transaction history, all in one place

- To redeem your Quicken offer and get more information about Quicken, install your TurboTax software and click “Claim this offer” (applies to new Quicken subscribers only)

WINDOWS SYSTEM REQUIREMENTS

NOTE: TurboTax Business is Windows Only

Operating Systems Windows 8, Windows 8.1, Windows 10 (Windows 7 not supported)

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

Monitor 1024x768 or higher recommended.

Third Party Software Microsoft .NET 4.5.2 (included with TurboTax Installer)

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Windows-compatible inkjet or laser printer. Administrative rights required

MAC SYSTEM REQUIREMENTS

Operating Systems macOS Mojave 10.14, Catalina 10.15

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax.

Monitor 1024x768 or higher recommended.

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Macintosh-compatible inkjet or laser printer.

Product description

TurboTax Premier is recommended if: you sold stock, bonds or mutual funds, sold employee stock (ESPP), own rental property or are a trust beneficiary. TurboTax is tailored to your unique situation—it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. • Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately. Free product support via phone. • Coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. • Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year’s data to help ensure accuracy and save you time • Up-to-date with the latest tax laws—so you can be confident your taxes will be done right • Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies

- TurboTax Premier is recommended if: you sold stock, bonds or mutual funds, sold employee stock (ESPP), own rental property or are a trust beneficiary

- Includes 5 free federal e-files and one download of a TurboTax state product ($40 value). State e-file sold separately. Free product support via phone

- Keep more of your investment and rental income

- Extra help for investment sales such as stocks, bonds, mutual funds, and employee stock plans

- Coaches you and double checks along the way

- Automatically imports W-2s, investment & mortgage information from participating companies (may require a free Intuit account) and imports prior year data from TurboTax and other tax software

- Searches 350+ deductions and credits, including tax-saving rental property deductions plus maximizing charitable donations with ItsDeductible

User questions & answers

| Question: | State e file sold separately |

| Answer: | Yes. TurboTax Premier 2020 will come with a download of a state product to ensure you can prepare your state taxes, but if your wish to e-file there is a separate fee. This can be avoided by choosing to print and mail your return. |

| Question: | I live outside the us. is it not possible to download if i live outside the country |

| Answer: | Yes, you are able to download TurboTax Premier 2020 Federal + State if you live outside the country. It is possible to download if your computer has the minimum system requirements. In order to find out, you can Google "2020 TurboTax CD/Download Minimum requirements for your computer" as well as "TurboTax Filing Taxes While Overseas" for more information about filing taxes overseas. |

| Question: | Does this version handle roth contributions and ira to roth conversions |

| Answer: | Every TurboTax version is designed to handle different tax situations. We recommend you visiting our TurboTax Community for further guidance on which product will be best suited for your specific needs. To start, we suggest searching for the article titled: "Where do I find Form 8606?" in the community. Please note that not all forms are available at this time. Updates will continue to be made to the software as tax forms are finalized by the IRS. More information can be found in the article titled: "When will my forms be ready?" |

| Question: | How much additional charge to e-file a state return on top of this |

| Answer: | The current price for a state e-file is $20. Please keep in mind this is subject to change at any time. |

Product features

Get your taxes done right with TurboTax 2020

- Keep more of your investment and rental income

- Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately.

- Free product support via phone

- Extra help for investment sales such as stocks, bonds, mutual funds, and employee stock plans

- Automatically imports W-2s, investment & mortgage information from participating companies (may require a free Intuit account)

Free Trial of Quicken Starter Edition 2021

- Get your complete financial picture at a glance--view balances, budgets, accounts and transactions, see spending trends and search transaction history, all in one place

- To redeem your Quicken offer and get more information about Quicken, install your TurboTax software and click “Claim this offer” (applies to new Quicken subscribers only)

WINDOWS SYSTEM REQUIREMENTS

NOTE: TurboTax Business is Windows Only

Operating Systems Windows 8, Windows 8.1, Windows 10 (Windows 7 not supported)

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

Monitor 1024x768 or higher recommended.

Third Party Software Microsoft .NET 4.5.2 (included with TurboTax Installer)

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Windows-compatible inkjet or laser printer. Administrative rights required

MAC SYSTEM REQUIREMENTS

Operating Systems macOS Mojave 10.14, Catalina 10.15

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax.

Monitor 1024x768 or higher recommended.

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Macintosh-compatible inkjet or laser printer.

Product description

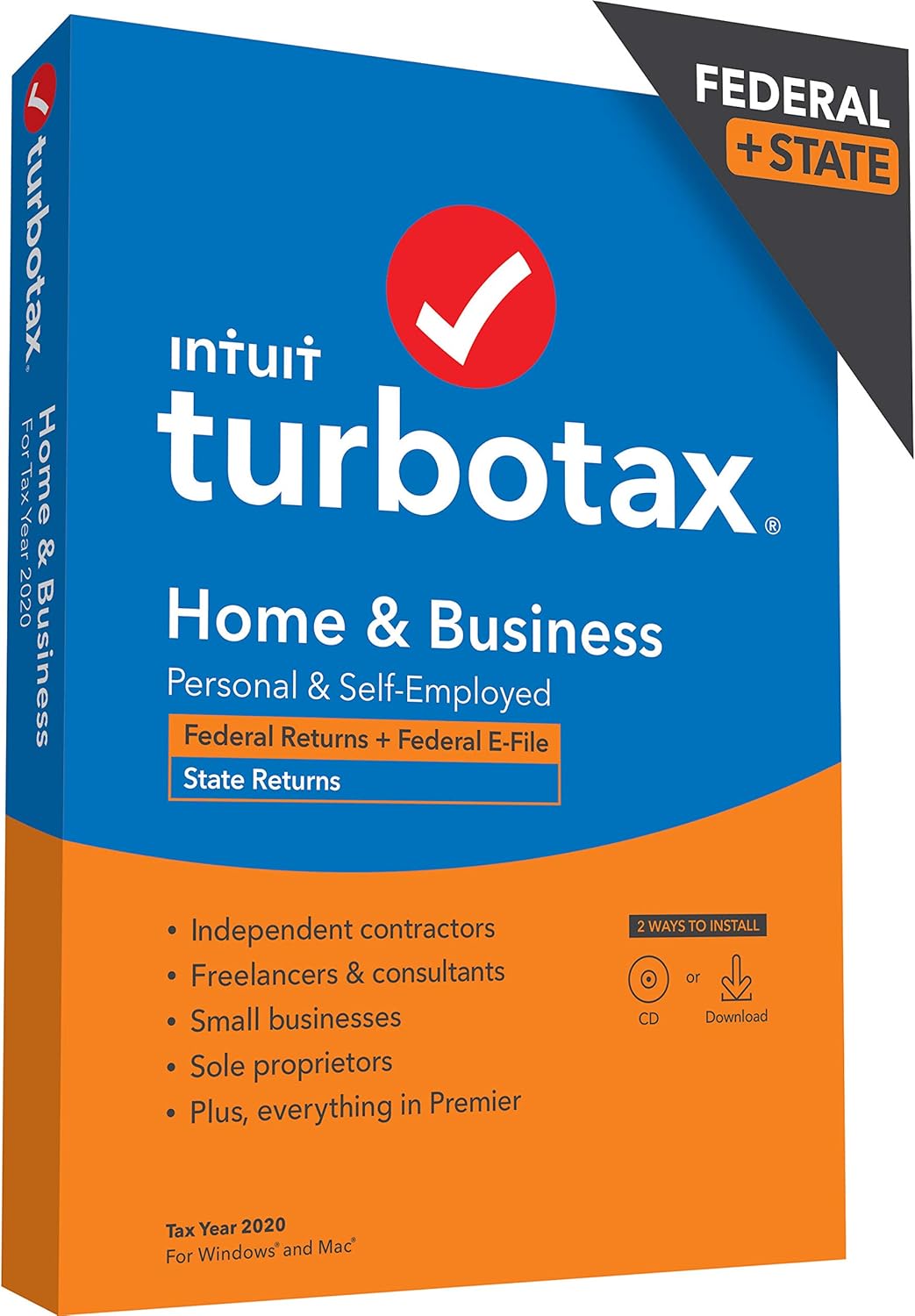

TurboTax Home & Business is recommended if: you are self-employed, an independent contractor, a freelancer, a small business owner, a sole proprietor, have a home office or home-based business

- TurboTax Home & Business is recommended if: you are self-employed, an independent contractor, a freelancer, a small business owner, a sole proprietor, have a home office or home-based business

- Includes 5 free federal e-files and one download of a TurboTax state product ($40 value). State e-file sold separately. Free product support via phone

- Extra guidance for rental property income, expenses, refinancing and self-employment & business deductions

- Double checks your return along the way

- Searches 350+ deductions and credits, including industry-specific tax deductions plus maximizing charitable donations with ItsDeductible

- Save time with simplified asset depreciation and reporting

- Create W-2 and 1099 tax forms for employees & contractors

User questions & answers

| Question: | If you have a 6th or 7th return to file, how much does it cost to submit via TurboTax |

| Answer: | The regular TTax platforms only allow up to 5 returns to be EFiled, per computer. If you have 2 computers, then you can file 5 on each PC. The Federal returns are free, but there is a $25 charge for each State EFiling. |

| Question: | Oil royalties |

| Answer: | If you receive a 1099-MISC for the royalties from the oil rights you have, then yes, TurboTax Home and Business will be able to help you record that information accurately. However, if you have to create any K-1s for those royalties, then you would need to use TurboTax Business. Keep in mind that TurboTax Business is only available for Windows as a Download or CD and will not create personal returns. We recommend searching our TurboTax Community website for more information on reporting mineral rights by searching the article titled "How do I create W-2 and 1099 forms for my employees or contractors?". Please note TurboTax Home & Business for Mac doesn't support the filing of W-2 and 1099 forms. You can also post your own question to be answered by our community of experts. |

| Question: | Is this a good version to use for lyft drivers |

| Answer: | TurboTax Home & Business is a great choice for Lyft drivers. It focuses the guided interview for those in the following scenarios and more: you are self-employed, an independent contractor, a freelancer, a small business owner, a sole proprietor, have a home office or home-based business. |

| Question: | What version do I need if I sold some of my stocks but I’m also self-employeed |

| Answer: | Personal and home business version |

Product features

Get your taxes done right with TurboTax 2020

- Get your personal and self-employed taxes done right

- Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately.

- Free product support via phone

- Extra guidance for self-employment & business deductions

- Double checks your return along the way

- Boost your bottom line with industry-specific tax deductions

Free Trial of Quicken Starter Edition 2021

- Get your complete financial picture at a glance--view balances, budgets, accounts and transactions, see spending trends and search transaction history, all in one place

- To redeem your Quicken offer and get more information about Quicken, install your TurboTax software and click “Claim this offer” (applies to new Quicken subscribers only)

WINDOWS SYSTEM REQUIREMENTS

NOTE: TurboTax Business is Windows Only

Operating Systems Windows 8, Windows 8.1, Windows 10 (Windows 7 not supported)

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

Monitor 1024x768 or higher recommended.

Third Party Software Microsoft .NET 4.5.2 (included with TurboTax Installer)

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Windows-compatible inkjet or laser printer. Administrative rights required

MAC SYSTEM REQUIREMENTS

Operating Systems macOS Mojave 10.14, Catalina 10.15

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax.

Monitor 1024x768 or higher recommended.

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Macintosh-compatible inkjet or laser printer.

Product description

TurboTax Deluxe is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child-related expenses or have a lot of deductions TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you're confident you'll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you're getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

• Help along the way-get answers to your product questions, so you won't get stuck.

• Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

- TurboTax Deluxe + State is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child related expenses or have a lot of deductions and need to file a federal and/or state income tax return

- Deluxe + State will accurately deduct mortage interest and propery taxes. Get your taxes done right and tailored to you, based on your unique situation.

- MAXIMUM TAX REFUND - Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT - TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s and mortgage information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files and one download of a TurboTax state product ($44.99 value) state e-file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

User questions & answers

| Question: | Is Schedule 1 included |

| Answer: | Yes, TurboTax Deluxe + State does include Schedule 1 (Additional Income and Adjustments to Income). |

| Question: | Will one purchase allow me to file returns for two different tax payers |

| Answer: | Yes. This product includes 5 free federal e-files and one download of a TurboTax state product(state e-file sold separately). Additional returns can be completed and filed by printing and mailing. |

| Question: | If i purchased this and can’t open on my macbook pro it says to use turbotax online, do i have to purchase again |

| Answer: | The following is suggested to help troubleshoot the issue described: 1. Visit https://amzn.to/2QAOBIz for detailed steps. 2. Contact Amazon support directly at https://amzn.to/2Gu40ER regarding your purchase. 3. On the Intuit Turbo Real Money Talk Community, help articles are available by searching for: Troubleshoot TurboTax for Mac. 4. Contact TurboTax customer care through Facebook or Twitter for additional support. |

| Question: | Does the box say it will work windows 7? turbotax help from their website says: "turbotax for tax year 2019 will install on windows 7, but |

| Answer: | As of January 14, 2020, Microsoft will no longer provide security updates or support for PCs running Windows 7. While you will still be able to install TurboTax for Tax Year 2019 on Windows 7, computers running on Windows 7 will be more vulnerable to security risks and viruses. To avoid these risks, Microsoft recommends that Windows 7 users upgrade to Windows 10. |

Product features

Get your taxes done right with TurboTax

- TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations.

- Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time.

- Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

- Help along the way - get answers to your product questions, so you won't get stuck.

- Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

WINDOWS SYSTEM REQUIREMENTS

PROCESSOR: Pentium 4 or Later/Athlon or Later

OPERATING SYSTEMS: Windows 8 or later (Windows 7 not supported)

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed)

PRINTER: Any Windows compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required.

Product activation required via Internet.

MAC SYSTEM REQUIREMENTS

PROCESSOR: Multi-core Intel Processor with 64-bit Support

OPERATING SYSTEMS: macOS High Sierra 10.13 or later

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax

PRINTER: Any Macintosh-compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required

Product activation required via Internet.

Product description

TurboTax Deluxe is recommended if: you own a home, have charitable donations to deduct, have high medical expenses, and only need to file a Federal Tax Return

- TurboTax Deluxe is recommended if: you own a home, have charitable donations to deduct, have high medical expenses, and only need to file a Federal Tax Return

- Includes five federal e-files. State download and e-file additional. Free product support via phone.

- Get your taxes done right and your maximum refund

- Extra help to maximize 350+ deductions and credits, including maximizing charitable donations with ItsDeductible

- Coaches you and double checks every step of the way

- Automatically imports W-2s, investment & mortgage information from participating companies (may require free Intuit account) and imports prior year data from TurboTax and other tax software

- Accurately deduct mortgage interest and property taxes

User questions & answers

| Question: | Can this product be loaded on more than one computer |

| Answer: | Yes, the TurboTax Deluxe 2020 product may be installed on up to 5 computers. Please know that each installation can complete 5 federal e-files and up to 3 state e-files per federal return. You may print and mail as many returns as you want. |

| Question: | Will it import from last year's H&R Block |

| Answer: | Yes, it will pick up any tax files on your computer or laptop. |

| Question: | what does Amazon exclusive mean |

| Answer: | Meaning that Amazon was one of the 1st places to offer TurboTax 2020 software before other places. |

| Question: | what is the difference between Disc and CD Rom |

| Answer: | The TurboTax Deluxe 2020 disc and download products both include five free federal e-files. Please know that you will need an internet connection for both versions during the installation process. The only difference is the method of installation. The TurboTax Deluxe 2020 download product will be directly added to your computer and requires you to set up a free Intuit account. The TurboTax Deluxe 2020 disc product will need to be installed via a drive onto your computer. |

Product features

Get your taxes done right with TurboTax 2020

- Get your taxes done right and your maximum refund

- Includes five federal e-files. State download and e-file additional.

- Free product support via phone

- Extra help to maximize 350+ deductions and credits

- Accurately deduct mortgage interest and property taxes

- Coaches you and double checks every step of the way

Free Trial of Quicken Starter Edition 2021

- Get your complete financial picture at a glance--view balances, budgets, accounts and transactions, see spending trends and search transaction history, all in one place

- To redeem your Quicken offer and get more information about Quicken, install your TurboTax software and click “Claim this offer” (applies to new Quicken subscribers only)

WINDOWS SYSTEM REQUIREMENTS

NOTE: TurboTax Business is Windows Only

Operating Systems Windows 8, Windows 8.1, Windows 10 (Windows 7 not supported)

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

Monitor 1024x768 or higher recommended.

Third Party Software Microsoft .NET 4.5.2 (included with TurboTax Installer)

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Windows-compatible inkjet or laser printer. Administrative rights required

MAC SYSTEM REQUIREMENTS

Operating Systems macOS Mojave 10.14, Catalina 10.15

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax.

Monitor 1024x768 or higher recommended.

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Macintosh-compatible inkjet or laser printer.

Product description

TurboTax Business is recommended if: you have a partnership, own a S or C Corp, Multi-Member LLC, manage a trust or estate, file a separate tax return for my business.

- TurboTax Business is recommended if: you have a partnership, own a S or C Corp, Multi-Member LLC, manage a trust or estate, file a separate tax return for my business.

- Includes 5 free federal e-files. Business State is sold separately. Free product support via phone.

- Prepare and file your business or trust taxes with confidence

- Get guidance in reporting income and expenses

- Boost your bottom line with industry-specific tax deductions

- Create W-2 and 1099 tax forms for employees and contractors

- Easily import your data from QuickBooks Desktop (2018 and later)

User questions & answers

| Question: | Does tt business 2020 prepare the new irs 1099-nec, and can it file the state copy electronically with new jersey |

| Answer: | Yes, tt business 2020 has all 1099 forms including 1099-NEC. State copy sold it separately. |

| Question: | Can turbotax business e-file state returns now? specifically for filing return for trust in state of az |

| Answer: | Each state has varying dates that e-file is allowed. The IRS is not accepting tax returns until Feb12th. And Go to the Ar Dept of Revenue , Income Tax Division. Good luck. |

| Question: | Where can I obtain the state version (Georgia), sold separately |

| Answer: | You would download the state version through Turbotax. |

| Question: | When will I received the disk ordered |

| Answer: | took me three days |

Product features

Get your business taxes done right with TurboTax 2020

- Prepare and file your business or trust taxes with confidence

- Includes 5 free federal e-files. Business State is sold separately.

- Free product support via phone

- Get guidance in reporting income and expenses

- Boost your bottom line with industry-specific tax deductions

- Take care of partnership, S Corp, C Corp, multi-member LLC or trust forms

- Create W-2 and 1099 tax forms for employees and contractors

WINDOWS SYSTEM REQUIREMENTS

NOTE: TurboTax Business is Windows Only

Operating Systems Windows 8, Windows 8.1, Windows 10 (Windows 7 not supported)

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

Monitor 1024x768 or higher recommended.

Third Party Software Microsoft .NET 4.5.2 (included with TurboTax Installer)

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Windows-compatible inkjet or laser printer. Administrative rights required

Product description

TurboTax Deluxe is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child-related expenses or have a lot of deductions TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you're confident you'll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you're getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

• Help along the way-get answers to your product questions, so you won't get stuck.

• Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

- TurboTax Deluxe + State is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child related expenses or have a lot of deductions and need to file a federal and/or state income tax return

- Deluxe + State will accurately deduct mortage interest and propery taxes. Get your taxes done right and tailored to you, based on your unique situation.

- MAXIMUM TAX REFUND - Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT - TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s and mortgage information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files and one download of a TurboTax state product ($44.99 value) state e-file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

User questions & answers

| Question: | how much is the additional efile for NY State |

| Answer: | New York e-file is free. |

| Question: | Is this the version to use for 2019 taxes (filing in 2020)? The TurboTax website indicates that they are still only accepting pre-orders for |

| Answer: | Yes, this software is for the 2019 tax year, which will be due in April 2020. This product will give you an immediate download. |

| Question: | Will this work using Windows |

| Answer: | It works fine under Windows 7. I used it to do my taxes this year and had no issues with it. The following companies have stated they will continue to support Windows 7: 1) Google Chrome for 18 months after Jan 2020, 2) Firefox for 24 months after Jan 2020 3) Avast Antivirus (free or paid version for 24 months after Jan 2020) Let's not forget that Windows 7 is still officially supported through 2023 for paying customers (unfortunately that doesn't include home users), so even if there was a big "ZERO" day exploit, chances are good that not only will it impact Windows 7 users, but also Windows 8/8.1 and Windows 10 users, we just don't know if Microsoft will make the patch available for Windows 7 users. About the only people that are not going to support Windows after this year is Intuit, which means next year I will be doing my taxes by pencil again, as Linux is not something they are interested in. Right now if anyone is telling you not to use Windows 7, it's scare tactics. I was able to update my machine last week even though support ended a month ago. You'll be okay running Windows 7 this year. |

| Question: | Does 2019 Deluxe + State version support stock sales and stock dividends |

| Answer: | Something else to consider. If you're not sure you can fill in the information using the Deluxe program, you can get the Premier (one-time) then next year get the Deluxe program and you can view the forms at any time and enter the values in the appropriate boxes. All you get with the Premier is $ome extra interview question$ when it comes to stock sale/dividends. FWIW, I have been using the Deluxe program for more than 20 years and have been able to report my stock sales and stock dividends w/o any issues. After a certain time in the new year you can choose to import your information from various financial institutions as well. |

Product features

Get your taxes done right with TurboTax

- TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations.

- Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time.

- Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

- Help along the way - get answers to your product questions, so you won't get stuck.

- Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

WINDOWS SYSTEM REQUIREMENTS

PROCESSOR: Pentium 4 or Later/Athlon or Later

OPERATING SYSTEMS: Windows 8 or later (Windows 7 not supported)

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed)

PRINTER: Any Windows compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required.

Product activation required via Internet.

MAC SYSTEM REQUIREMENTS

PROCESSOR: Multi-core Intel Processor with 64-bit Support

OPERATING SYSTEMS: macOS High Sierra 10.13 or later

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax

PRINTER: Any Macintosh-compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required

Product activation required via Internet.

Product description

Intuit TurboTax Deluxe 2020 Tax Software [Amazon Exclusive][PC/Mac Disc] + $10 Gift Card

- Buy the TurboTax + Gift Card bundle on 12/26 and get a $10 Amazon Gift Card with your purchase of TurboTax

- TurboTax Deluxe is recommended if: you own a home, have charitable donations to deduct, have high medical expenses, and only need to file a Federal Tax Return

- Includes five federal e-files. State download and e-file additional. Free product support via phone.

- Get your taxes done right and your maximum refund

- Extra help to maximize 350+ deductions and credits, including maximizing charitable donations with ItsDeductible

- Coaches you and double checks every step of the way

- Automatically imports W-2s, investment & mortgage information from participating companies (may require free Intuit account) and imports prior year data from TurboTax and other tax software

User questions & answers

| Question: | Almost purchased this but noticed in the description that the $10.00 gift card is for a purchase ON 12/26. Why do you still display the gift card |

| Answer: | This deal of the day that was for 12/26 was by Amazon. Please contact Amazon customer service for more on this deal. |

| Question: | What does a pc disc mean? or how does it look like? is it like a cd or a different kinda disc |

| Answer: | The TurboTax Deluxe 2020 disc is a CD version that can be used to install via a CD drive on any computer running either Mac or Windows that meets our system requirements. |

| Question: | How do I install my TurboTax program into another computer |

| Answer: | If you have purchased the Download through Amazon, you can find the software in your Amazon Software Library. To get to your Amazon Software Library, simply search for "Games and Software Library" in your Amazon search bar. You will then see the option to Manage your game and software downloads. Click Download next to the game or software you want to download. When your download completes, click Install to start the installation. Follow the onscreen instructions. Tip: If your purchase includes a Product key, one is displayed under the item's title in Your Games and Software Library. You are prompted to enter this Product key during the installation process. The license code provided when you purchase can be used to activate the software on up to 5 computers owned by you (either in your home or at work). |

| Question: | For the 2020 filing, which turbo tax program lets you file both the federal and one state return on line |

| Answer: | All of our TurboTax 2020 products let you e-file both your federal and state returns. If you need to file state, we recommend getting one of our TurboTax products that bundle a state download with the product. Please note: There is a separate charge to e-file state returns on the desktop product and can be avoided by printing and mailing it. If you want to prepare and file completely online, we recommend using TurboTax Online through our website. |

Product features

Get your taxes done right with TurboTax 2020

- Get your taxes done right and your maximum refund

- Includes five federal e-files. State download and e-file additional.

- Free product support via phone

- Extra help to maximize 350+ deductions and credits

- Accurately deduct mortgage interest and property taxes

- Coaches you and double checks every step of the way

Free Trial of Quicken Starter Edition 2021

- Get your complete financial picture at a glance--view balances, budgets, accounts and transactions, see spending trends and search transaction history, all in one place

- To redeem your Quicken offer and get more information about Quicken, install your TurboTax software and click “Claim this offer” (applies to new Quicken subscribers only)

WINDOWS SYSTEM REQUIREMENTS

NOTE: TurboTax Business is Windows Only

Operating Systems Windows 8, Windows 8.1, Windows 10 (Windows 7 not supported)

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

Monitor 1024x768 or higher recommended.

Third Party Software Microsoft .NET 4.5.2 (included with TurboTax Installer)

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Windows-compatible inkjet or laser printer. Administrative rights required

MAC SYSTEM REQUIREMENTS

Operating Systems macOS Mojave 10.14, Catalina 10.15

RAM 2 GB or more recommended

Hard Disk Space 1 GB for TurboTax.

Monitor 1024x768 or higher recommended.

Internet Connection 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

Printer Any Macintosh-compatible inkjet or laser printer.

Product description

TurboTax Home & Business is recommended if you received income from a side job or are self-employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W-2 and 1099 MISC forms for employees or contractors, you file your personal and self-employed tax together (if you own an S Corp, C Corp, Partnership or multiple-owner LLC, choose TurboTax Business). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you're confident you'll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you're getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right. Help along the way-get answers to your product questions, so you won't get stuck.

• Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

- TurboTax Home & Business + State is recommended to maximize your deductions for personal and self employed tax situations especially if you received income from a side job

- Best for those who are self-employed or an independent contractor, freelancer, consultant or sole proprietor

- MAXIMUM TAX REFUND- Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT - TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s, mortgage and investment information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files and one download of a TurboTax state product ($44.99 value) state e-file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

User questions & answers

| Question: | Does this give me access to the webbased version of turbo tax |

| Answer: | must purchase the webbased version |

| Question: | Does this software work for expats |

| Answer: | Yes, TurboTax will support filing U.S. or state return for expats. Helpful information on accomplishing this is available on our Turbo Real Money Talk online community. |

| Question: | I have to have this on at least 3 pc's as i move around during the year, can i load this onto 3 pc's |

| Answer: | I think the answer to your question about how many computers you can load Turbo Tax on to is on the license agreement that you have to accept or reject. I'm thinking it was two. |

| Question: | Intuit offers a 60-day "Satisfaction guaranteed or your money back", but Amazon says, "non-returnable and non-refundable." Which is it |

| Answer: | A whole lot of headache. Amazon says tough, but if you figure out how to contact the right department and establish purchase to intuit they either refund or rebate your next purchase. |

Product features

Get your taxes done right with TurboTax

- TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations.

- Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time.

- Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

- Help along the way-get answers to your product questions, so you won't get stuck.

- Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

WINDOWS SYSTEM REQUIREMENTS

PROCESSOR: Pentium 4 or Later/Athlon or Later

OPERATING SYSTEMS: Windows 8 or later (Windows 7 not supported)

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed)

PRINTER: Any Windows compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required.

Product activation required via Internet.

MAC SYSTEM REQUIREMENTS

PROCESSOR: Multi-core Intel Processor with 64-bit Support

OPERATING SYSTEMS: macOS High Sierra 10.13 or later

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax

PRINTER: Any Macintosh-compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required

Product activation required via Internet.

Product description

TurboTax Deluxe is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child-related expenses or have a lot of deductions TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you're confident you'll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you're getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

• Help along the way-get answers to your product questions, so you won't get stuck.

• Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

- TurboTax Deluxe is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child related expenses or have a lot of deductions and only need to file a federal income tax return

- Deluxe will accurately deduct mortage interest and propery taxes. Get your taxes done right and tailored to you, based on your unique situation.

- MAXIMUM TAX REFUND - Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT - TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s and mortgage information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files, state preparation additional

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

Product features

Get your taxes done right with TurboTax

- TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations.

- Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time.

- Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

- Help along the way - get answers to your product questions, so you won't get stuck.

- Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

WINDOWS SYSTEM REQUIREMENTS

PROCESSOR: Pentium 4 or Later/Athlon or Later

OPERATING SYSTEMS: Windows 8 or later (Windows 7 not supported)

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed)

PRINTER: Any Windows compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required.

Product activation required via Internet.

MAC SYSTEM REQUIREMENTS

PROCESSOR: Multi-core Intel Processor with 64-bit Support

OPERATING SYSTEMS: macOS High Sierra 10.13 or later

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax

PRINTER: Any Macintosh-compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required

Product activation required via Internet.

Product description

TurboTax Premier is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K-1 form). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you're confident you'll get your maximum refund

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you're getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right. Help along the way-get answers to your product questions, so you won't get stuck.

• Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

- TurboTax Premier + State is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K 1 form)

- With Premier, retirement tax help and the IRA tool show you how to get more money back this year and when you retire. Keep more of your investment and rental income. Get your taxes done right and tailored to you, based on your unique situation.

- MAXIMUM TAX REFUND - Searches for more than 350+ tax deductions and credits, including mortgage interest, property taxes and energy-efficient improvements, to get you everything you deserve

- TAXES DONE RIGHT - TurboTax guides you through your tax preparation, keeping you up to date with the latest tax laws and double checking your entries along the way.

- SAVE TIME- Automatically imports financial information including W-2s, mortgage and investment information as well as imports prior year tax return information from TurboTax and other tax software.

- Includes 5 free federal e-files and one download of a TurboTax state product ($44.99 value) state e-file sold separately

- Exclusively at Amazon, receive a free 1 year subscription to Quicken Starter Edition ($34.95 value) with your purchase of TurboTax

User questions & answers

| Question: | what is the fee to e-file Massachusetts state tax when using Turbotax Premier |

| Answer: | $19.99 or $24.99 |

| Question: | Does turbo tax premier work on chrome |

| Answer: | No, the minimum operating system requirements for this software are Windows 8, Windows 8.1, and Windows 10 or macOS High Sierra 10.13 or later. If you wish to use Chrome, please consider our TurboTax online products that can be used with Chromebooks, with 73.x as a minimum operating system requirement. |

| Question: | Will this version work for entering ride share income info |

| Answer: | While Premire contains the forms to complete for rideshare filing, we recommend the 2019 TurboTax Home & Business + State to get the guided interview questions to ensure information is being accurately entered. You can purchase Home and Business + State here: https://amzn.to/2w0w6pz. If you are comfortable manually entering your information, you can use Premier in Forms Mode. While using Forms Mode will not prevent you from e-filing, it does void the TurboTax Accuracy Guarantee. If you override any values that were calculated by TurboTax, this will void the Accuracy Guarantee and you will be unable to e-file. However, you would still be able to print and file your return. You may also find it helpful to google the article "TurboTax Tax Tips for Uber, Lyft, Juno and Other Car Sharing Drivers" for additional information. |

| Question: | Why can’t state e-file included in this ? How much extra I need to pay for state e-file if I purchase products |

| Answer: | They charge $19.95 to eFile MI state return. I had a lot of technical issues last year because I tried to bypass that feature and spend 49 cents to mail the state. |

Product features

Get your taxes done right with TurboTax

- TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations.

- Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time.

- Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

- Help along the way - get answers to your product questions, so you won't get stuck.

- Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

WINDOWS SYSTEM REQUIREMENTS

PROCESSOR: Pentium 4 or Later/Athlon or Later

OPERATING SYSTEMS: Windows 8 or later (Windows 7 not supported)

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed)

PRINTER: Any Windows compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required.

Product activation required via Internet.

MAC SYSTEM REQUIREMENTS

PROCESSOR: Multi-core Intel Processor with 64-bit Support

OPERATING SYSTEMS: macOS High Sierra 10.13 or later

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax

PRINTER: Any Macintosh-compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required

Product activation required via Internet.

Product description

TurboTax Business is recommended if your small business is a partnership, S Corp, C Corp, multi-member LLC, or for trusts and estates. TurboTax is tailored to your unique situation-it will search for the business deductions and credits you deserve

• TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you're getting every dollar you deserve.

• Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time

• Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

• Help along the way-get answers to your product questions, so you won't get stuck.

• Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

- TurboTax Business works best if your small business is a partnership, S Corp, C Corp, multi-member LLC, or for trusts and estates

- Prepare and file your business or trust taxes with confidence

- Get guidance in reporting income and expenses

- Boost your bottom line with industry specific tax deductions

- Create W 2 and 1099 tax forms for employees and contractors

- Includes 5 free federal e-files, state preparation additional. Windows only

- Save time with streamlined asset depreciation and reporting as well as importing prior year tax data

User questions & answers

| Question: | How is amazon offering this product for $35 less than any other retailer (quill/staples)? why would intuit provide this favored amazon-only price |

| Answer: | I wish I knew. Maybe it's because Amazon buys in bulk. It seems odd but now that I know, I'm going to cancel my automatic purchase each November from Intuit and buy it from Amazon at a lower price! |

| Question: | Does this product allow for filing back taxes or 2018 llc taxes as well? or would i need to purchase turbotax's 2018 business tax software as well |

| Answer: | To file 2018 taxes, you will need the 2018 version. Additionally, you will need to print and mail the return, efile will not be available for previous years returns. |

| Question: | Does tt business have 1120s and k-1 forms to file for my s corp |

| Answer: | Use TurboTax Business (Windows only) if you need to file a return for a corporation (Form 1120), S corporation (Form 1120-S), partnership or multi-member LLC (Form 1065), estate/trust income (Form 1041), or homeowner association (1120-H). TurboTax Business doesn't cover personal (1040) returns, either with or without Schedule C. If you're in business for yourself and haven't incorporated or created an LLC, we recommend TurboTax Self-Employed (online) or TurboTax Home & Business (CD/download) to file your personal and business taxes. |

| Question: | This for 2019 year right |

| Answer: | For tax return year 2019, March 16th 2020 is the date by which many businesses (but not all) must file tax returns. Failure to do so will lead to a fine, which can be hefty. |

Product features

Get your taxes done right with TurboTax

- TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations.

- Every year it gets even easier. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time.

- Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

- Help along the way-get answers to your product questions, so you won't get stuck.

- Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies.

WINDOWS SYSTEM REQUIREMENTS

PROCESSOR: Pentium 4 or Later/Athlon or Later

OPERATING SYSTEMS: Windows 8 or later (Windows 7 not supported)

MONITOR: 1024x768 or higher recommended

RAM: 2 GB or more recommended

INTERNET CONNECTION: 1 MBps modem (Broadband connection highly recommended). Required for product activation and updates

HARD DISK SPACE: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed)

PRINTER: Any Windows compatible inkjet or laser printer

THIRD PARTY SOFTWARE: Win: Microsoft .NET 4.5.2 (included with TurboTax Installer). Administrative rights required.

Product activation required via Internet.

Latest Reviews

View all

Small Outdoor Space Heater

- Updated: 01.06.2023

- Read reviews

Books On Emotional Intelligences

- Updated: 18.04.2023

- Read reviews

Green Toys Best Selling Toys

- Updated: 09.01.2023

- Read reviews

Chicago Pneumatic Pens

- Updated: 02.05.2023

- Read reviews

Timex Work Watches

- Updated: 01.07.2023

- Read reviews