12 best accounting books

Accounting books, in the context of business and finance, refer to the physical or digital records and documents used to maintain a systematic and organized record of a company's financial transactions. These books play a crucial role in managing a company's finances, ensuring compliance with tax regulations, and providing valuable insights into its financial health. Here are some key aspects of accounting books:

Ledger: The ledger is a fundamental accounting book used to record all financial transactions of a business. It typically includes two main types: the general ledger, which contains a summary of all transactions, and subsidiary ledgers, which provide detailed information about specific accounts (e.g., accounts receivable, accounts payable).

Journal: The journal is where financial transactions are initially recorded in chronological order. Each entry in the journal includes details like the date, description of the transaction, debit (money going out), and credit (money coming in) amounts. Journals are then used to update the general ledger.

Income Statement: This book, also known as the profit and loss statement (P&L), summarizes a company's revenues, expenses, gains, and losses over a specific period. It helps assess the company's profitability.

Balance Sheet: The balance sheet provides a snapshot of a company's financial position at a given moment. It lists the company's assets (what it owns), liabilities (what it owes), and shareholders' equity (the residual interest in assets after deducting liabilities).

Cash Flow Statement: This book tracks the inflow and outflow of cash within a specific period. It helps assess a company's liquidity and cash management.

Receipts and Invoices: These documents are essential for recording sales, purchases, and other financial transactions. They include information such as the date, description of the transaction, amounts, and payment terms.

Tax Records: Proper accounting books are essential for calculating and reporting taxes accurately. Businesses must maintain records for income tax, sales tax, and payroll tax purposes.

Bank Statements: Bank statements are a primary source of information for reconciling cash transactions and ensuring that recorded financial data aligns with actual bank account activity.

Depreciation Schedules: For businesses with assets subject to depreciation (e.g., buildings, equipment), depreciation schedules are used to allocate the cost of these assets over their useful life.

Accounting Software: Many businesses use accounting software to maintain their accounting books efficiently. These software solutions automate data entry, generate financial reports, and facilitate compliance with accounting standards.

Auditing and Compliance: Maintaining accurate accounting books is crucial for auditing purposes. It ensures that a business complies with financial reporting regulations and provides transparency to stakeholders.

Financial Analysis: Accounting books are not just records; they serve as the basis for financial analysis and decision-making.They help assess profitability, solvency, and liquidity and provide insights for strategic planning.

Accurate and well-maintained accounting books are essential for the financial health and success of a business. They provide a historical record of financial activities and serve as a foundation for financial reporting, analysis, and decision-making. Proper accounting practices are crucial for businesses of all sizes and industries.

Below you can find our editor's choice of the best accounting books on the marketProduct description

This income and expense book is great for any small business to make sure they are financially on track.

- Income & Expense Log Book - Record Income and Expenses by Day, Week, and Month

- Wire-O book with color cover and TransLux cover for protection with the Title "INCOME & EXPENSE"

- Book lies flat when open, Page Dimensions: 8 1/2" x 11", acid-free, 60 lb. paper

- Record and track your income and expenses with ease using the fillable templates for profit&oss, monthly expenses, income, daily/weekly/monthly/yearly totals

- Made in USA, Proudly Produced in Ohio. Veteran-Owned.

Product description

These professional grade Account Books are designed to be easy to use and durable. With individually numbered 4 column pages, these books are essential for recording and keeping accurate account records. Made in USA.

- Hardbound book with grain-finished leather-like burgundy cover and square binding

- Tamper-evident, Archival quality, Off-white Eye-Ease Acid-Free Paper

- Smyth sewn – book lies flat when open, Page Dimensions: 8” x 10” (20.3cm x 25.4cm), Page Count: 96 Pages

- Features "Owner Information Page with fields for recording Owner's name, address, book number, start date, end date, etc

- Made in USA, Proudly Produced in Ohio. Veteran-Owned.

User questions & answers

| Question: | Hi this would be my first accounting book. Do they columns each have a particular or designated purpose? Not sure what goes where. Thanks |

| Answer: | It is a standard format you would need to consult and accountant for this information. Thank you. Felicia/BookFactory |

| Question: | Is this paper in the book fountain pen/roller ball pen friendly? No feathering or bleed through |

| Answer: | The answer is simply no! I have used the same fine-point Waterman fountain pen for book-keeping for decades. As fountain pens are relegated to the artsy journal crowd, notebook and account book paper has become less impervious to bleeding. This book is no exception. |

| Question: | No tienen el National brand account book de 8 columnsa 9.25 x |

| Answer: | We do not sell National Brand. This book is made by BookFactory. Thank you. Felicia/BookFactory |

| Question: | why, can't I found Adams 8 column columnar book |

| Answer: | This book has four columns on each page. I made my accounting book into a 13 columns on each page. All you need is a ruler and a pen. |

Latest Reviews

View all

Avalon Wall Light Fixtures

- Updated: 31.01.2023

- Read reviews

Dash Cam Gp

- Updated: 11.03.2023

- Read reviews

Mens Wedding Bands

- Updated: 27.03.2023

- Read reviews

Michael Connelly Books

- Updated: 14.06.2023

- Read reviews

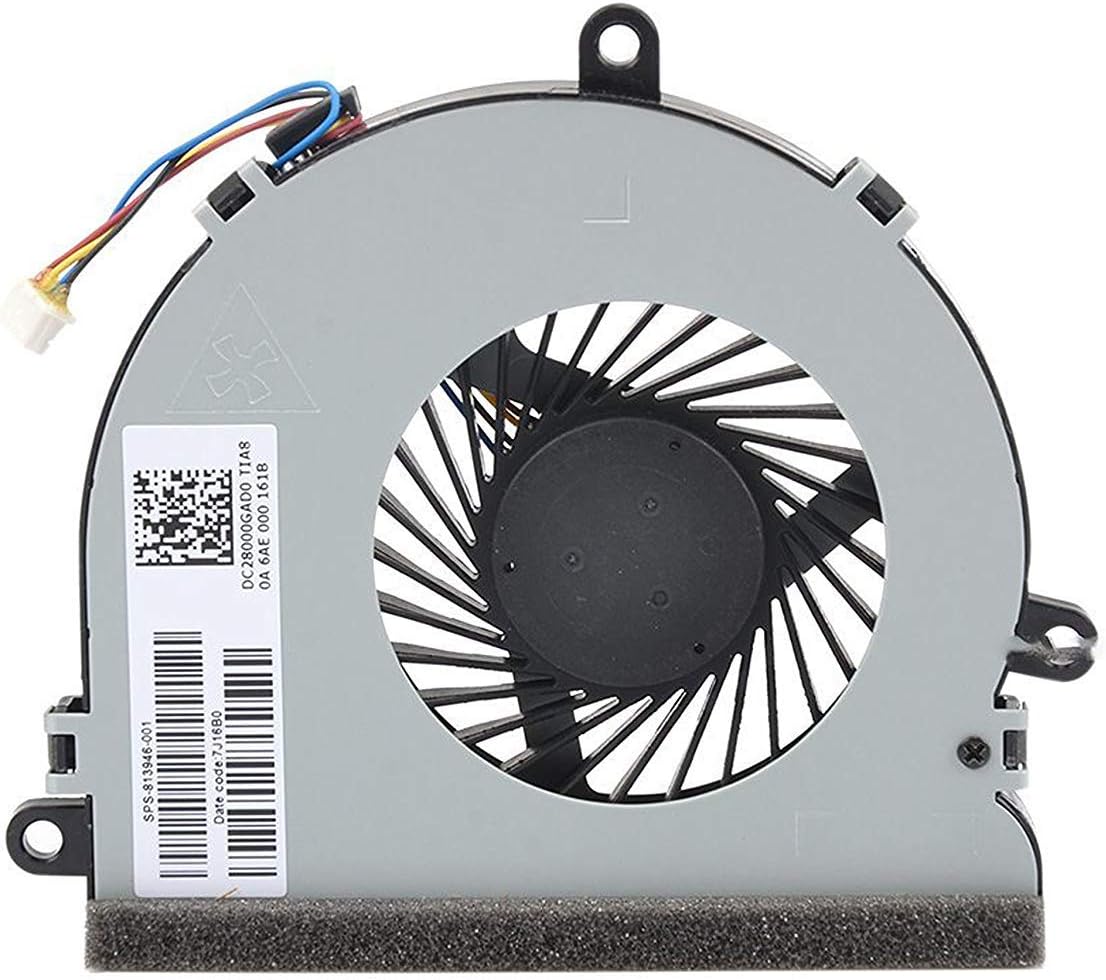

Hp Fan For Coolings

- Updated: 16.02.2023

- Read reviews